Tourism Land Rent: Key Pieces of Information to Finance Directors of Maldives Resorts and Hotels

24 March 2024

Finance Directors of Maldives Resorts and Hotels play a key role in forecasting, budgeting and cash flow management of the property. In this regard, land rent/land lease payment of the property payable to the Government of Maldives is a vital payment and substantial sum that the Finance Directors will have to budget and arrange funds for towards the end of each quarter.

This quick guide provides key pieces of information to Finance Directors of Maldives Resorts and Hotels in respect of tourism land rent applicable to islands, lagoons or lands leased for the development and operation of a tourism property.

1. What is Tourism Land Rent?

Tourism Land Rent is charged pursuant to the Maldives Tourism Act (Act No. 2/99) (the “Tourism Act”) and Regulation on the Payment of Land Rent to the Government in relation to Islands, Lagoons and Lands Leased for Tourism Purposes (Regulation No. 2022/R-33) (the “Land Rent Regulation”).

Tourism Land Rent is applicable to islands, lagoons or lands leased by the Government of Maldives for the development and operation of a tourism property. In this respect, land rent will be applicable to Tourist Resorts, Tourist Hotels, Tourist Guesthouses, Yacht Marinas, Integrated Tourist Resorts and Private Islands (“Property”).

When to Start Paying?

Land rent payments kick in from the date of expiry of the construction period provided in the Head Lease Agreement* or from the commission date** of the Property, whichever happens earlier. Generally, the construction period granted under the Head Lease Agreement for islands and lagoons is 36 months and 48 months, respectively.

*Head Lease Agreement is the lease agreement signed between the Government, represented by the Ministry of Tourism, and head lessee specifying the terms under which an island, lagoon or land is leased to the head lessee by the Government for development and operation of the Property.

**Commission Date is the date at which the Ministry of Tourism grants permission for the operation of the Property.

2. Land Rent is based on the Registered Land Area

Land rent payable by a Property is determined based on the registered land area of the specific Property. The land area of the Property is calculated on the basis of the ‘mean tideline’ of the Property – determined by a survey carried out by a surveyor registered at the Maldives Land & Survey Authority.

Prior to the commencement of the land rent payments (as stated in paragraph 3 under first heading), the head leaseholder will be required to carry out the land survey and submit the Land Survey Report prepared by the registered surveyor to the Ministry of Tourism (MOT) for the purposes of land area registration. After registration of land area at the MOT is completed, land rent for the Property has to be paid based on the registered land area of the Property.

Registration of land area at the MOT will be confirmed upon the MOT issuing a ‘Land Area Registration Letter’ to the head leaseholder confirming the (i) registration of land area for the Property and (ii) registered land area of the Property.

3. How will the Land Rent be calculated if the Land Area is not yet Registered at the MOT?

Until the land area of the Property is duly registered at the MOT, the land area of the Property will be deemed as the land area stated in the site plan approved for the island, lagoon or land leased by the MOT.

Where there is no approved site plan for the island, lagoon or land, the following rules will be used to determine the temporary land area of the island, lagoon or land.

Determination of Temporary Land Area

- For Islands – Temporary land area will be deemed as the land area specified in the records of the relevant government authority overseeing matters of uninhabited islands.

- For Lagoons – Temporary land area will be based on the reef line of the whole lagoon.

- For Lands – Temporary land area will be based on the land area specified in the Head Lease Agreement for the lease of the respective plot or the land area designated for the land in the specific island’s urban plan – if the land is situated in an inhabited island.

Availability of a temporary land area (as above) does not fulfil the obligation on the leaseholder to carry out the land survey and register the land area at the MOT – meaning, official land area registration process has to be completed regardless of the availability of a temporary land area.

4. Adjustment of Land Rent paid based on Temporary Land Area

Upon registration of the land area at the MOT, the land rent for the Property will be recalculated based on the registered land area from the date land rent payments kicked in/commenced for the Property. This may result in a shortfall or an excess payment – which will be treated as follows:

| Land Rent Paid based on Temporary Land Area | Treatment |

| Is less | Shortfall/unpaid portion of the land rent has to be settled in equal quarterly instalments over a period not exceeding 5 years. |

| Is more | Excess portion of the paid rent will be set off against land rent quarterly payment(s) that is next due. |

5. Can the Land Area be Reviewed After Registration at the MOT?

Land area registered at the MOT can be reviewed if the leaseholder wishes so and if the MOT instructs the Property to do so. The cost of such review, in both cases, will be to the account of the leaseholder. The only exception to this rule (i.e. situation where MOT has to be responsible for arranging the cost of review) is where the MOT instructs to review the land area of the Property within a 5 year period from when the land area was last registered.

Once the review is complete, the land survey report has to be submitted and the new land area will have to be registered at the MOT – based on which the new land rent will be calculated. In the situation where the land area of the property changes after the review – which results in a change in the land rent for the property – no adjustments will be made for the land rent payments that were settled for previous periods.

6. Land Rent Rates

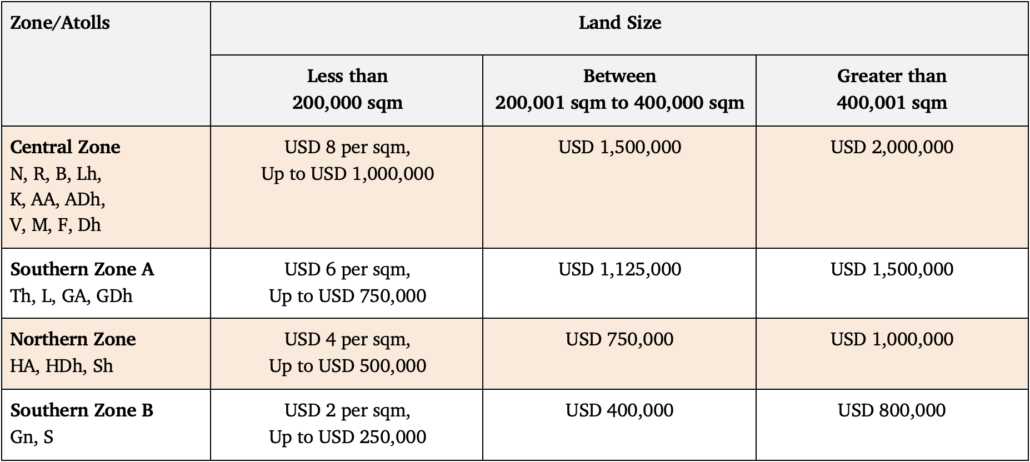

Tourism land rent rates are set out in the Tourism Act and are based on the size/area of the Property, geographical location/region of the Property within the Maldives and whether the Property is situated in an uninhabited or inhabited island. The table below provides the applicable land rent rates per annum for islands and lands that fall into uninhabited islands category.

For Properties located in inhabited islands, excluding Malé City, the categorization is similar to the above table; however, the applicable land rent rates are half of what has been stated above for all zones.

7. Computation and Collection of Land Rent

Computing, charging and collecting land rent based on the registered land area confirmation provided by the MOT for tourist establishments is mandated over the Maldives Inland Revenue Authority (MIRA) pursuant to the Land Rent Regulation. In addition, charging fines and sending notices for late payment is also mandated over MIRA.

However, if the tourism land is located in an inhabited island – which falls within the jurisdiction of an island council/city council – then collection of land rent and enforcement measures due to non-payment will be carried out by the relevant council having jurisdiction over the land.

Since MIRA is the authority mandated to compute the land rent applicable for a specific Property based on the land area confirmed by MOT, MIRA will maintain a “Land Rent Schedule” for each Property and the land rent schedule will be communicated to the head leaseholder of the Property by MIRA or issued to the head leaseholder of the Property, upon request.

8. Terms of Payment

Land rent payment has to be settled in United States Dollars (USD) and is calculated on a calendar year basis starting from 1 January and ending on 31 December. Payment has to be settled on a quarterly basis (i.e. in 4 quarters) and each quarter’s payment has to be settled before the commencement of each quarter to the MIRA in order to avoid any late payment fines.

Fine for Late Payment

The currently applicable rate for late payment of land rent is 0.0493% of the amount due for each day of delay, starting from the day the land rent payment fell due to until the date of payment. Pursuant to the Land Rent Regulation, the late payment fine rate of 0.0493% has been put into effect from 29 July 2019 for all Properties regardless of the Head Lease Agreement specifying another higher rate.

9. Land Rent Deferral During Construction or Redevelopment Period

In circumstances where the (i) construction period granted to develop the Property is extended or (ii) Property is closed for redevelopment, the MOT has the discretion to grant deferral of land rent payments in relation to the Property. In such cases, the deferral of land rent will be confirmed by an Addendum made to the Head Lease Agreement.

10. Consequences of Not Registering Land Area

Considerable fines are stated in the Land Rent Regulation if the land area is not registered with the MOT – which are as follows:

- If it is an Island leased for tourism purposes – MVR 100,000 (i.e approx. USD 6,485.08)

- Lagoon – MVR 100,000 (i.e approx. USD 6,485.08)

- Land leased from an uninhabited island – MVR 50,000 (i.e approx. USD 3,242.54)

- Land leased from an inhabited island – based on the situation and extent of breach a fine not exceeding MVR 50,000 (i.e approx. USD 3,242.54)

Further, the Land Rent Regulation also provides that if the land size of the Tourism Property is increased without obtaining the prior approval of the MOT, MOT has the discretion to impose a fine of MVR 100,000 (i.e approx. USD 6,485.08).